2024 NH Moore Public Schools Benefit Guide

Benefits Enrollment Guide 2024 - New Hires

Welcome to MPS Benefits Eligibility Full time employee Work 30 hours a week or more Spouse and dependent children (to age 26) of eligible employee Enrollment 30 days from hire date to enroll Be ready to provide address, birthdates, and social security numbers for you and any eligible dependents See next page for more information Important Benefits will become active at the beginning of the month You have coverage on the effective date even if the ID card has not yet arrived If you have any problems, please contact the carrier first, then escalate to HR if needed

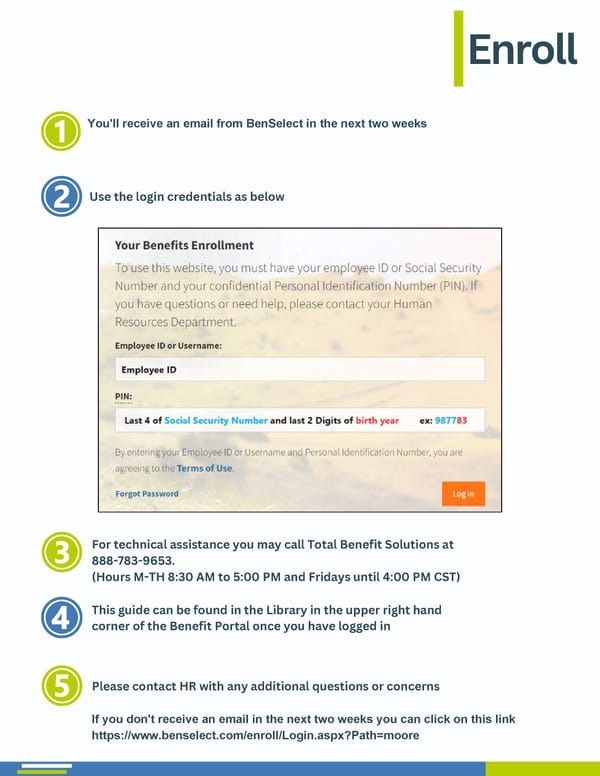

Enroll You'll receive an email from BenSelect in the next two weeks Use the login credentials as below For technical assistance you may call Total Benefit Solutions at 888-783-9653. (Hours M-TH 8:30 AM to 5:00 PM and Fridays until 4:00 PM CST) This guide can be found in the Library in the upper right hand corner of the Benefit Portal once you have logged in Please contact HR with any additional questions or concerns If you don't receive an email in the next two weeks you can click on this link https://www.benselect.com/enroll/Login.aspx?Path=moore

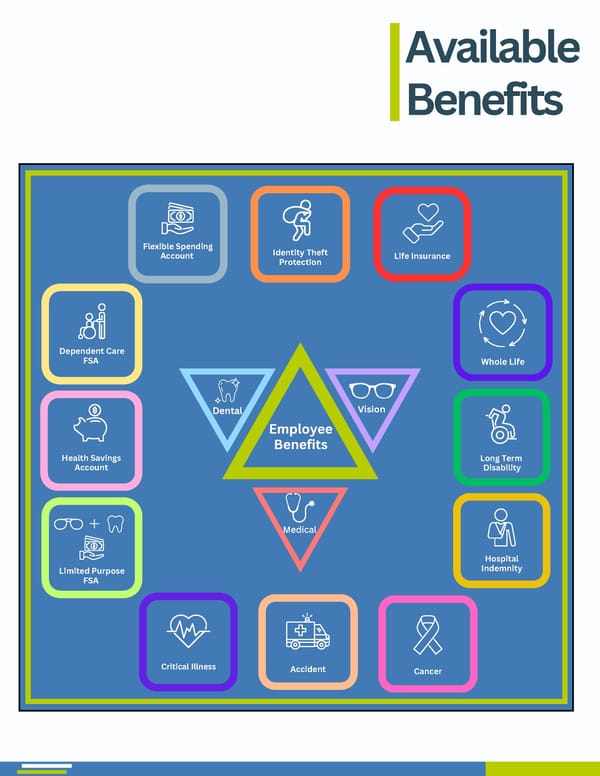

Available Benefits Flexible Spending Identity Theft Account Life Insurance Protection Dependent Care FSA Whole Life Vision Dental Employee Benefits Health Savings Long Term Account Disability Medical Hospital Indemnity Limited Purpose FSA Critical Illness Accident Cancer Accident Cancer

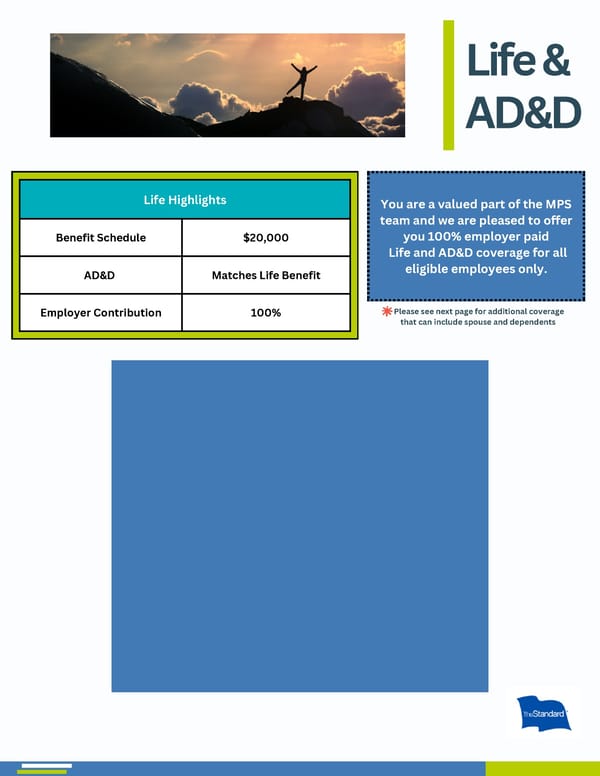

Life & AD&D Life Highlights You are a valued part of the MPS team and we are pleased to offer you 100% employer paid Benefit Schedule $20,000 Life and AD&D coverage for all eligible employees only. AD&D Matches Life Benefit Please see next page for additional coverage Employer Contribution 100% that can include spouse and dependents

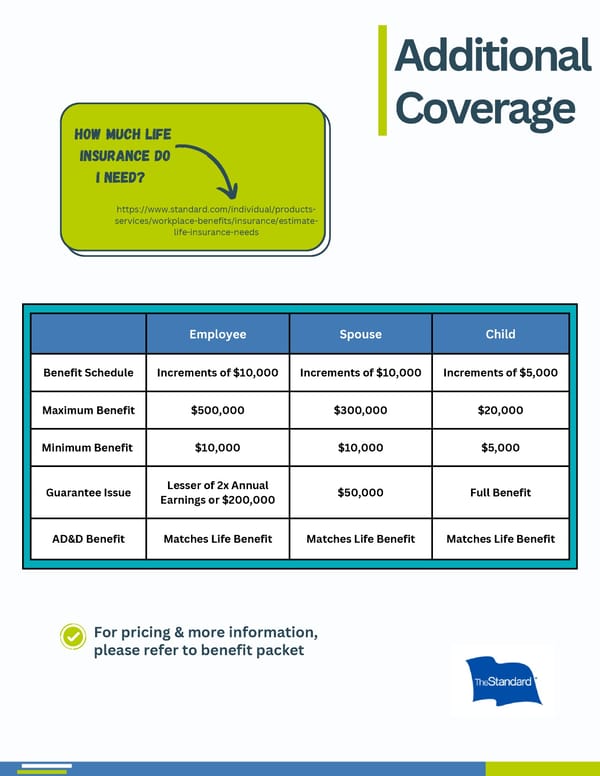

Additional Coverage How much Life Insurance do I need? https://www.standard.com/individual/products- services/workplace-benefits/insurance/estimate- life-insurance-needs Employee Spouse Child Benefit Schedule Increments of $10,000 Increments of $10,000 Increments of $5,000 Maximum Benefit $500,000 $300,000 $20,000 Minimum Benefit $10,000 $10,000 $5,000 Lesser of 2x Annual Guarantee Issue $50,000 Full Benefit Earnings or $200,000 AD&D Benefit Matches Life Benefit Matches Life Benefit Matches Life Benefit For pricing & more information, please refer to benefit packet

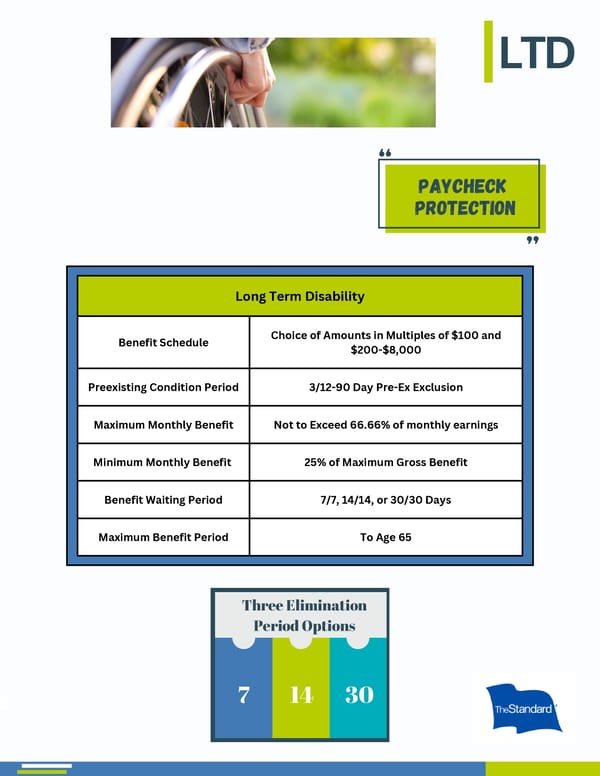

LTD paycheck protection Long Term Disability Choice of Amounts in Multiples of $100 and Benefit Schedule $200-$8,000 Preexisting Condition Period 3/12-90 Day Pre-Ex Exclusion Maximum Monthly Benefit Not to Exceed 66.66% of monthly earnings Minimum Monthly Benefit 25% of Maximum Gross Benefit Benefit Waiting Period 7/7, 14/14, or 30/30 Days Maximum Benefit Period To Age 65 Three Elimination Period Options 7 14 30

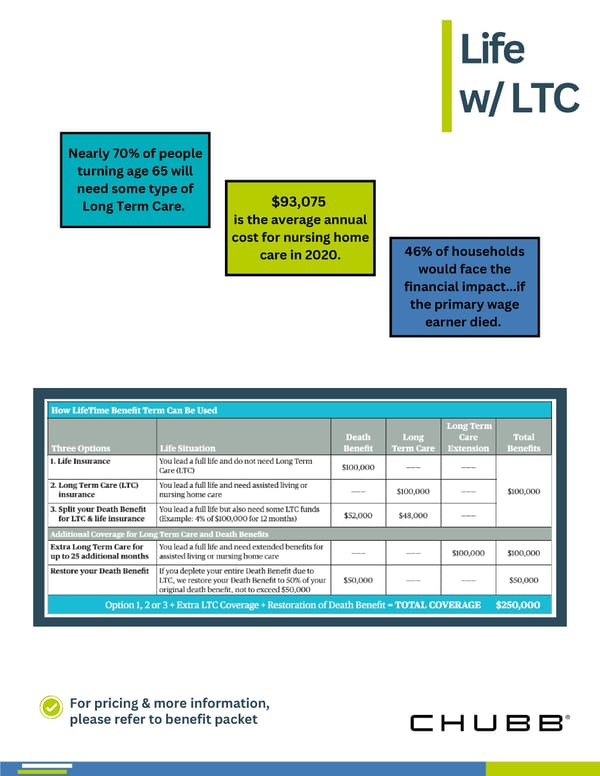

Life w/ LTC Nearly 70% of people turning age 65 will need some type of $93,075 Long Term Care. is the average annual cost for nursing home 46% of households care in 2020. would face the financial impact...if the primary wage earner died. For pricing & more information, please refer to benefit packet

FSA What is a Flexible Spending Account? use account to pay for general a savings account filled with a out of pocket predetermined pre-taxed amount health costs from your paycheck each pay cycle unused funds contribution do NOT roll over limit of $3,200 to next year The IRS does NOT allow you to contribute to a healthcare FSA and HSA at the same time! For pricing & more information, please refer to benefit packet

Dependent Care FSA What is a Dependent Care FSA? a savings account to be used for any eligible dependent care expenses can use on a dependent under the age of 13 or dependents who cannot care for themselves annual contribution limit of $5,000 per household funds can only be used as they are desposited into your account For pricing & more information, please refer to benefit packet

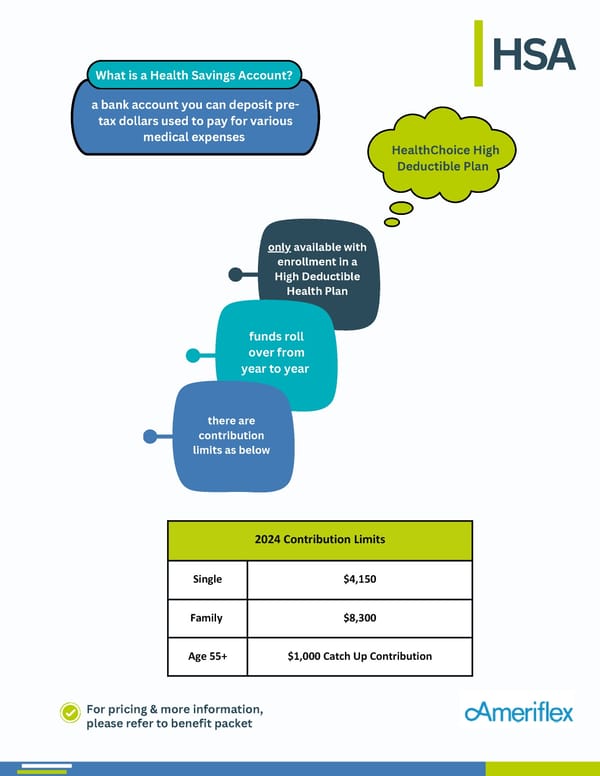

HSA What is a Health Savings Account? a bank account you can deposit pre- tax dollars used to pay for various medical expenses HealthChoice High Deductible Plan only available with enrollment in a High Deductible Health Plan funds roll over from year to year there are contribution limits as below 2024 Contribution Limits Single $4,150 Family $8,300 Age 55+ $1,000 Catch Up Contribution For pricing & more information, please refer to benefit packet

Limited Purpose What is a Limited Purpose FSA? a savings account that can ONLY be used for dental and vision expenses FSA only use for qualifying out of pocket dental and vision expenses annual contribution pre-tax benefit limit of $3,200 You MUST be enrolled in a HDHP to receive this type of FSA For pricing & more information, please refer to benefit packet

Accident Two Plan Options Option 1 Option 2 For pricing & more information, Did you know almost 1/3 of all injuries in please refer to benefit packet childhood are sports-related?

This is a modal window.

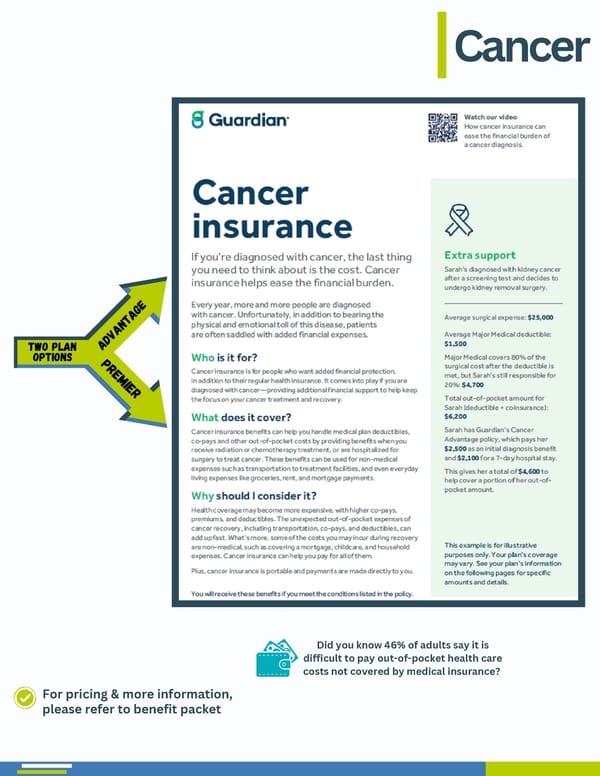

Cancer e g a t n a v d A Two Plan Options P r e m i e r Did you know 46% of adults say it is difficult to pay out-of-pocket health care costs not covered by medical insurance? For pricing & more information, please refer to benefit packet

This is a modal window.

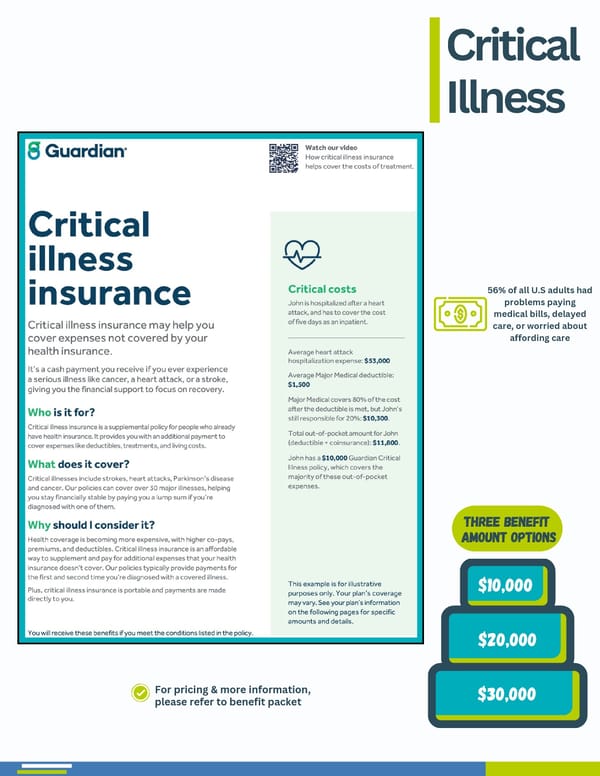

Critical Illness 56% of all U.S adults had problems paying medical bills, delayed care, or worried about affording care Three Benefit Amount Options $10,000 $20,000 For pricing & more information, $30,000 please refer to benefit packet

This is a modal window.

Hospital DID YOU KNOW? Indemnity 33,356,853 AMERICANS WERE HOSPITALIZED IN 2022* Plan Design Hospital Confinement Benefit $250/Day Number of Covered Days Per Hospital 15 Days Hospital Admission $1,000/Calendar Year Critical Care Unit (CCU) Confinement-Pays in Addition to Hospital $250/Day Confinement Number of Covered Days Per CCU 15 Days For pricing & more information, please refer to benefit packet *Source: AHA Hospital Statistics 2022

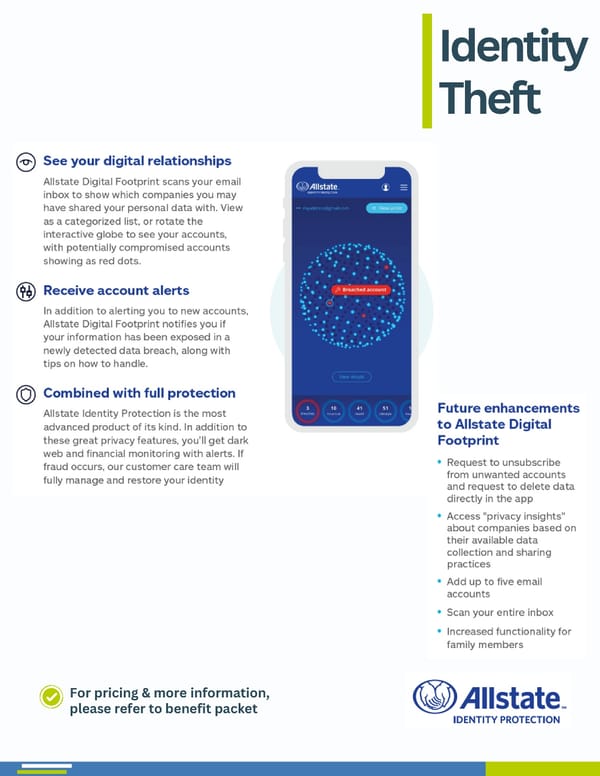

Identity Theft For pricing & more information, please refer to benefit packet

Contact Info Cheryl Hendrix 888-868-3539 800.628.8600 405.735.4202 [email protected] https://www.standard.com/individual [email protected] /contact/contact-us 888.482.7342 800.726.6033 800.682.4822 https://www.guardianlife.com/ https://www.allstate.com/help- https://www.chubb.com contact-us support/contact

THANK YOU for being a part of our team!